- Robert's Newsletter

- Posts

- RFS DeFi Risk Intelligence Weekly

RFS DeFi Risk Intelligence Weekly

Institutional-Grade DeFi Risk Monitoring brought to you by RFS Consulting

Welcome to this week’s edition of RFS DeFi Risk Intelligence Weekly, your go-to source for institutional-grade DeFi insights, risk intelligence, and onchain strategy.

Here’s whats new this week:

🚨 Market Updates

Total DeFi TVL: $89.3B (+3.5% WoW)

Stablecoin Market Cap: $161.2B (steady)

ETH Staked: 32.1M ETH (+1.2% WoW)

💡Key drivers: Renewed optimism around ETH ETF flows, BTC range-bound volatility, and continued L2 ecosystem growth.

📉 RFS Risk Scores - Week of July 7th, 2025

Risk Factor | Risk Score | Commentary |

|---|---|---|

RFS Protocol Risk Score | 6.7 / 10 | Slightly increased due to higher market volatility and new smart contract exploits identified last week |

Liquidity Depth Index (LDI) | 74% | Stronger overall pool stability across Curve and Uniswap |

Stablecoin Depeg Risk Index | 14% | Low, driven by steady onchain liquidity and new cross-chain bridge integrations |

Yield Basis Spread | 2.3% | A narrowing spread between stable lending and high-risk yield opportunities, signaling reduced “risk-on” appetite among whales |

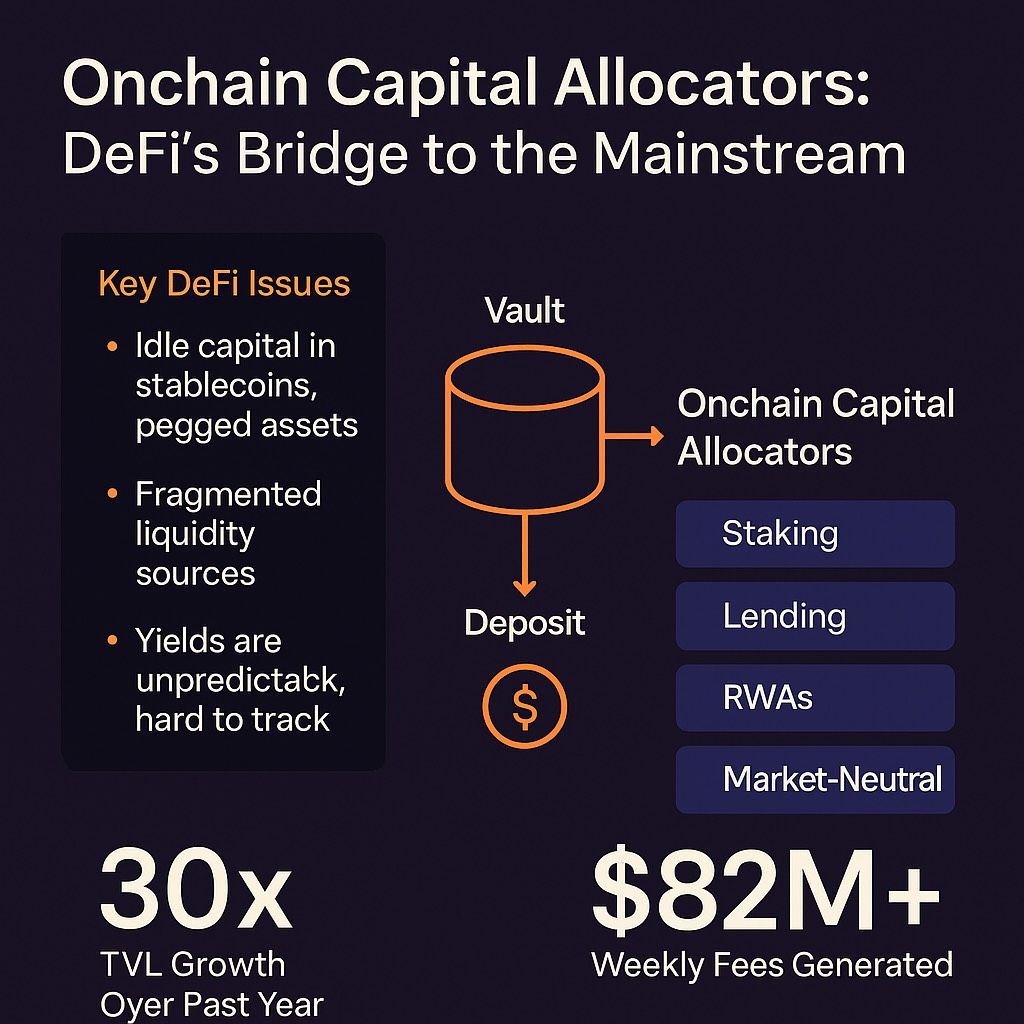

📊 Feature Insight: Onchain Capital Allocators — DeFi’s Bridge to the Mainstream

DeFi isn’t just for degens anymore. A new generation of Onchain Capital Allocators is making DeFi more accessible, risk-managed, and suitable for mainstream and institutional adoption.

These allocators operate like transparent, programmable fund managers. Users deposit assets into onchain vaults, and the protocol automatically routes capital into diversified strategies:

Staking & restaking

Lending & borrowing

Real-world assets (RWAs)

Market-neutral/arbitrage

Key Institutional Analytics

TVL Growth: Nearly 30x over the past year.

Weekly Fees Generated: Over $82M, highlighting robust usage.

Risk Diversification: Cross-chain, multi-strategy allocations improve capital efficiency and reduce strategy concentration risk.

Transparency: Fully auditable onchain performance data, critical for compliance and institutional reporting.

How Onchain Capital Allocators Work

🔬 Educational Corner: Impermanent Loss & DeFi Liquidity

This week, we’re revisiting the math behind impermanent loss (IL) — a key risk in AMM (automated market maker) pools. IL occurs when you provide two assets to a liquidity pool and their relative price shifts, leading to reduced value upon withdrawal compared to simple holding.

While there isn't a single "equation" that directly gives you the dollar value of impermanent loss without knowing the initial and final states of your assets and the pool, the core mathematical relationship that governs AMMs and leads to IL is the Constant Product Formula.

The Constant Product Formula:

Most commonly, AMMs like Uniswap V2 use the constant product formula:

x ∗ y = k

Where:

x = Quantity of the first token in the liquidity pool

y = Quantity of the second token in the liquidity pool

k = A constant value (the "invariant")

This formula ensures that the product of the quantities of the two tokens always remains constant, even as trades occur. When one token is bought from the pool, its quantity decreases, and the quantity of the other token (the one used to buy it) increases, all while maintaining the constant product k. This rebalancing is what causes the price of the tokens within the pool to adjust.

☝🏾 We’ll break this down further with visuals and mitigation strategies in next week’s edition.

📰 Quick Hits & Trends

Plume Network x TRON:

Real-world yield strategies integrated via SkyLink. Read more below:

BBVA Spain

BTC and ETH trading + custody for retail clients launched. Read more below:

Stablecoins as Money:

Deep dive from a16z on stablecoins’ monetary evolution. Read more below:

🙇🏾♀️ Camryn’s Corner

Welcome to another segment of ‘Camryn’s Corner’ brought to you by your co-author and editor! Each week I will highlight my top 5 DeFi Applications, Protocols, or other news worthy subjects in the crypto and DeFi world:

It's an exciting time in DeFi, with continuous innovation and significant capital shifts. While "performance" can be measured in various ways (TVL growth, revenue, user adoption, token price), Total Value Locked (TVL) is a crucial metric, indicating the amount of assets locked within a protocol, reflecting user trust and liquidity.

Based on the latest available data for 2025, here are 5 DeFi protocols that have shown notable activity and strong positioning.

Top DeFi Protocols by Activity and TVL (Year-to-Date 2025)

Here are five prominent DeFi protocols that have demonstrated significant activity and maintained strong TVL figures so far this year:

Aave:

Description: A leading decentralized lending and borrowing protocol. Users can lend assets to earn interest or borrow by providing collateral. It supports a wide range of cryptocurrencies and operates across multiple blockchains.

Noteworthy: Continues to be a cornerstone of DeFi, consistently maintaining one of the highest TVLs. Its robust ecosystem, flash loans, and cross-chain capabilities contribute to its sustained relevance. As of June 2025, its TVL is reported around $24.4 - $25+ billion.

Lido:

Description: The largest liquid staking protocol, primarily for Ethereum (ETH) but also supporting other assets like Polygon (MATIC) and Solana (SOL). It allows users to stake their tokens while retaining liquidity through liquid staking derivatives (e.g., stETH), which can then be used in other DeFi applications.

Noteworthy: Dominates the liquid staking landscape, enabling users to earn staking rewards without locking up their assets. Its model of providing liquid derivatives has cemented its position. As of June 2025, its TVL is around $22.4 - $22.6 billion.

EigenLayer:

Description: A restaking protocol on Ethereum that allows staked ETH to be "re-staked" to secure other decentralized networks and services, thus earning additional yield. It introduces a new primitive for shared security and incentivizes broader decentralization.

Noteworthy: Has seen remarkable growth and quickly climbed the ranks due to its innovative restaking mechanism, attracting significant capital from ETH stakers looking for additional yield opportunities. Its TVL reached around $10.9 - $14.3 billion by June 2025.

Uniswap:

Description: The largest decentralized exchange (DEX) by trading volume. Uniswap utilizes an Automated Market Maker (AMM) model, allowing users to swap tokens and provide liquidity to earn trading fees.

Noteworthy: Despite market fluctuations, Uniswap remains the most used DEX, continuously innovating with features like concentrated liquidity (V3) and expanding to numerous chains. Its reported TVL as of June 2025 is around $3.7 - $6.05 billion, having doubled since October 2024, indicating strong recovery and continued usage.

Sky Protocol (formerly MakerDAO):

Description: The decentralized autonomous organization (DAO) responsible for creating and governing DAI, a decentralized stablecoin pegged to the US dollar. Users can generate DAI by collateralizing various crypto assets. The rebrand to "Sky Protocol" signifies an evolution in its offerings.

Noteworthy: As one of the oldest and most established DeFi protocols, its stability and governance model around DAI have made it a critical piece of DeFi infrastructure. Its TVL is reported to be around $4.9 - $5.9 billion as of June 2025.

🙍🏾♂️ About RFS Consulting

At RFS, we believe the future of DeFi depends on merging high-yield innovation with institutional-grade risk management and transparency.

Our proprietary RFS Risk Scores & Metrics give you a unique edge, helping you navigate the complexities of DeFi with confidence and clarity.

👉🏾 Or contact us at [email protected] to discuss integrating these metrics into your treasury or portfolio strategy.

🫱🏽🫲🏿 Support RFS Risk Intelligence Weekly

If you enjoy our weekly research and want to support continued independent risk analysis, consider:

Gif by xbox on Giphy

☕️ Buy Me a Coffee — Fuel future newsletters!

💸 Tip in USDC: Ethereum 0x695B71a929A21F2A260f61aEd09872DA053Bcc42 — secured via Gnosis Safe

💳 Tip via Stripe — One-time or recurring support.

📢 Call to Action

Now Accepting 3 Pilot Clients

We’re onboarding a limited number of DeFi protocols and institutional funds into our real-time risk scoring dashboard and DeFi compliance architecture.

💼 Custom engagements | Audit-aligned scoring | Institutional onboarding

👣 Follow RFS Consulting

🌐 Website

Till next time,

RFS DeFi Risk Intelligence Weekly

🔓Disclaimer: This content is for informational and educational purposes only. It does not constitute investment advice or a solicitation to buy or sell securities or digital assets.