- Robert's Newsletter

- Posts

- RFS DeFi Risk Intelligence Weekly

RFS DeFi Risk Intelligence Weekly

January 2nd, 2025 | Institutional Risk. Regulatory Signals. Onchain Reality.

2025 Recap + 2026 Trends Outlook (Institutional Edition)

Week of December 29th - January 2nd

Prepared by RFS Consulting LLC — Advancing Institutional DeFi Risk Intelligence

In Partnership with Gemach DAO

Welcome to Another Edition of RFS DeFi Risk Intelligence Weekly!

Your weekly breakdown of institutional digital asset risk, policy momentum, and real-time DeFi intelligence tailored for allocators, regulators, and enterprise leaders.

Here’s whats new this week:

🗞️ Enjoying RFS DeFi Risk Intelligence Weekly? Support the Research!

“Independent DeFi risk research takes time and resources. If you enjoy our insights, consider fueling the work with a small contribution below”

☕️ Buy Me a Coffee — Fuel future newsletters!

💸 Tip in USDC: Ethereum 0x695B71a929A21F2A260f61aEd09872DA053Bcc42 — secured via Gnosis Safe

💳 Tip via Stripe — One-time or recurring support.

📝 Executive Takeaways

2025 was the year institutions stopped debating whether digital assets belonged in professional portfolios and started debating how to engage responsibly. The conversation shifted decisively from curiosity and experimentation toward controls: governance frameworks, custody standards, liquidity management, and policy alignment. For the first time, digital asset discussions began to resemble traditional risk committee conversations rather than innovation workshops.

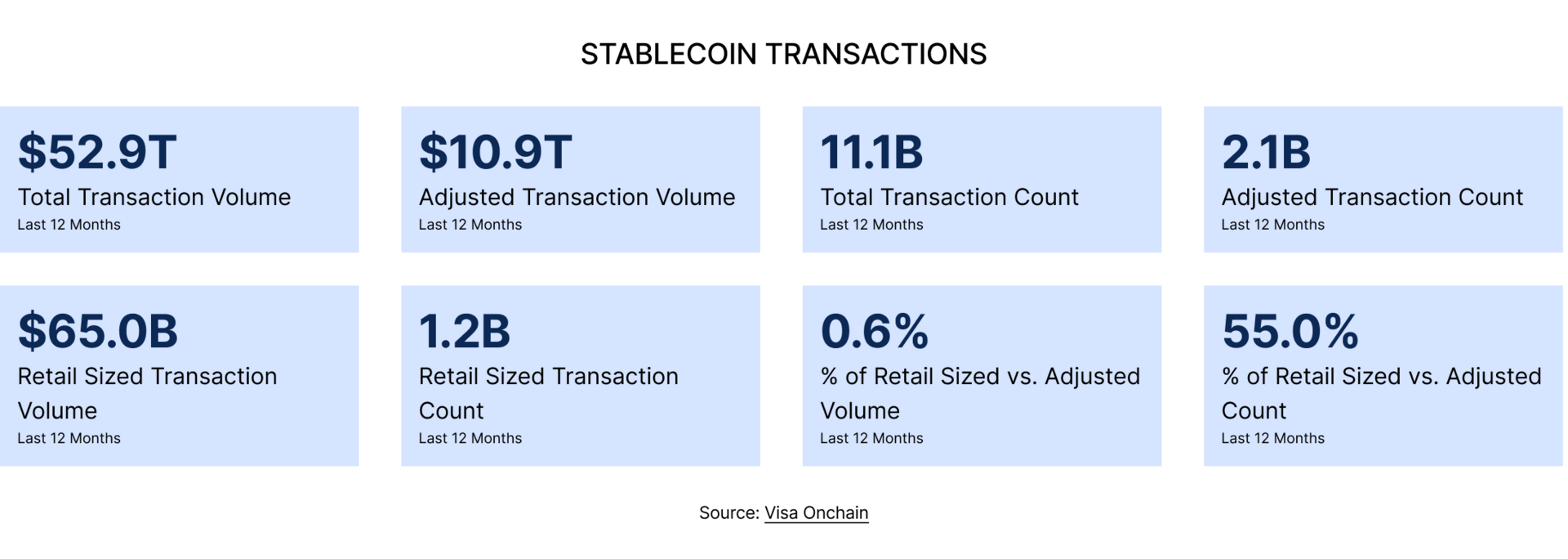

Stablecoins emerged as the centerpiece of this transition. No longer a side story or trading convenience, they became the core liquidity rail for onchain markets and tokenized settlement flows. As a result, questions around redemption mechanics, reserve transparency, counterparty concentration, and stress behavior moved from technical teams to boardrooms. Liquidity risk — not price volatility — is now the dominant lens through which stablecoins are evaluated.

By Chainalysis

Tokenization also crossed an important threshold. In 2025, it moved beyond pilots and proofs-of-concept toward genuine production intent. The likely winners will not be the flashiest chains or most experimental platforms, but the stacks that successfully integrate compliance, identity, settlement, and auditability. Looking ahead, 2026 will reward risk-native adoption — institutions that operationalize controls rather than chase narratives will unlock yield, efficiency, and optionality without incurring reputational or governance risk.

📆 2025: The Year in Review (What Actually Mattered)

1) Policy Momentum Became an Investable Signal

By the end of 2025, it became clear that regulation is not inherently anti-crypto — it is market-structure formation. Institutional participation is now gated by three converging policy pillars:

Stablecoin rules covering reserves, redemption rights, and disclosures

Token classification clarity (security vs. commodity vs. payment instrument)

Custody and compliance expectations defining who can hold what, and under which controls

RFS View 💬 Policy clarity compresses institutional decision cycles — but only for firms that have already built internal risk governance. Regulation accelerates adoption for the prepared and sidelines the unprepared.

2) Stablecoin Risk Was Re-Priced: From “Peg Risk” to “Liquidity Risk”

Once again, markets relearned that the existential threat to stablecoins is not daily price deviation, but run dynamics. Stress episodes highlighted the importance of:

Redemption bottlenecks and settlement timing

Counterparty concentration across banks and custodians

Reserve composition and liquidation paths

The gap between onchain liquidity depth and offchain redemption capacity

RFS View 💬 The emerging “stablecoin ratings” conversation is, at its core, a liquidity stress-testing conversation. Institutions will increasingly demand standardized metrics that reflect run risk, not marketing claims.

3) Tokenization Got Serious — Especially Around Settlement and Collateral

In 2025, tokenization evolved from a compelling demo into a balance-sheet utility. Institutions began to focus on tangible advantages:

Faster settlement and reduced counterparty exposure

Programmable compliance and transfer restrictions

Collateral mobility, borrowing concepts from repo markets

Improved auditability — when designed correctly

RFS View 💬 The next leap will come from tokenized instruments that are compliance-composable, integrating identity, attestations, reporting, and enforceable controls by design.

4) DeFi’s Institutional Wedge: Transparent Risk + Programmable Controls

Institutions did not rush headlong into DeFi. Instead, they selectively engaged where risk could be measured, controls embedded, liquidity verified, and smart contracts assured. Permissionless access was less important than permissioned pathways.

RFS view 💬 The institutional path forward is not “DeFi everywhere.” It is monitored exposure, auditable controls, and clearly defined risk boundaries.

📈 2026 Trends: What We’re Watching (and What to Do About It)

Trend 1 — Stablecoin Standards Harden into “Institutional Eligibility”

In 2026, stablecoins will increasingly fall into tiers: institutional-eligible versus market-only.

Signals to Track:

Redemption terms and frequency

Reserve transparency and attestations

Concentration risk across banks and custodians

Onchain liquidity coverage under stress

Institutional Action:

Establish a formal Stablecoin Investment & Treasury Policy with issuer limits, stress triggers, and quarterly run-risk simulations.

Trend 2 — Embedded Supervision Becomes a Real Product Category

Regulators and compliance teams are moving from post-hoc review to continuous supervision. Automated alerts, onchain monitoring, and governance-linked dashboards will become standard.

What to Build:

Control libraries (KYTx, sanctions hooks, allowlists/denylists)

Monitoring and audit trails designed for committees, not just engineers

RFS View 💬 Supervision that ships is the bridge from experimentation to scaled adoption.

Trend 3 — Tokenized Collateral and Onchain Credit Expand Cautiously

Growth will concentrate where collateral quality is transparent, liquidation paths are credible, and legal enforceability is understood.

Institutional Action:

Adopt collateral eligibility frameworks covering haircuts, liquidity tiers, oracle standards, independent audits, and incident response playbooks.

Trend 4 — Market Structure Compresses

Custody providers, brokers, and exchanges will converge as institutions seek fewer counterparties with clearer liability and reporting.

Key Filters:

Asset segregation

Bankruptcy remoteness

Operational resilience and incident history

Reporting quality (SOC reports, audits, transparency)

Trend 5 — Risk Scoring Becomes Table Stakes

By 2026, boards will expect standardized views of protocol risk, stablecoin liquidity risk, counterparty exposure, concentration, correlation, and governance risk.

RFS View 💬 The differentiator is not the score itself — it is the explainability and the control actions the score triggers.

📊 The RFS Lens: The 2026 Institutional Playbook

Institutions that succeed in 2026 will operate a simple, repeatable model:

Define eligibility across assets, stablecoins, protocols, and counterparties

Quantify exposure — liquidity, concentration, correlations

Embed controls via pre-trade and post-trade monitoring

Stress test regularly (runs, liquidity shocks, oracle failures)

Report like a risk function, using board-ready dashboards

🏆 RFS Risk Scoreboard (Institutional View) - Top Risk Drivers This Week:

Liquidity depth changes

Governance/proposal risk

Oracle dependencies

Concentration (issuer/custodian/counterparty)

Smart contract upgrade surface area

🙋🏽♀️ Questions Every Investment Committee Should Ask (2026 Edition)

If redemptions spike, what is our actual path to cash — same day or “eventually”?

What are our maximum exposures per stablecoin issuer and per custodian?

What is our kill-switch — what triggers halts or de-risking?

What is our smart-contract assurance standard and incident response plan?

Do we understand hidden correlations across ETH beta, liquidity, bridges, and oracles?

🙇🏾♀️ Camryn’s Corner - Year-End DeFi Reality Check: What Actually Held Up Under Stress in 2025

Welcome back to another edition of Camryn’s Corner, your weekly highlight reel of standout protocols, applications, and trends shaping the DeFi landscape. As 2025 comes to a close, this week’s focus is less about what moved fastest and more about what held up when it mattered. December’s volatility, liquidity rotations, and regulatory pressure provided a quiet but meaningful stress test for DeFi infrastructure — revealing which systems were built for durability and which still depend on favorable conditions.

By DL News

Across the ecosystem, the strongest performers shared a common trait: governance discipline. Stablecoins with transparent reserve management and predictable redemption mechanics absorbed elevated flows without disruption. Lending protocols that enforced conservative collateral parameters and actively managed risk avoided cascade liquidations, even as liquidity thinned. Meanwhile, chains and applications that prioritized throughput, monitoring, and operational clarity proved more resilient than those optimized primarily for incentive-driven growth. In contrast, protocols reliant on thin liquidity, aggressive leverage, or opaque off-chain dependencies showed stress quickly — often well before price dislocations appeared.

The takeaway for 2026 is clear: resilience is becoming the primary differentiator. Yield and narrative cycles will continue, but institutions are now anchoring decisions around liquidity resilience, governance quality, and system behavior under stress. DeFi’s next phase will not be defined by experimentation alone, but by its ability to function as reliable financial infrastructure — especially when conditions are least forgiving. What held up in 2025 is likely to define where serious capital flows next.

🕰️ What We’re Doing at RFS in 2026

Expanding RFS risk scoring into control-driven frameworks where scores trigger actions

Publishing institutional-grade research on stablecoin liquidity, tokenization, and embedded supervision

Building board-ready dashboards and monitoring for committees and regulators — not just traders

✍🏾 Closing Remarks

If 2025 was about permission to engage, 2026 is about permission to scale. The edge will belong to institutions that treat digital assets like any other risk-bearing market: controls first, narratives second.

👤 About RFS Consulting

RFS Consulting provides institutional-grade DeFi risk intelligence, regulatory analysis, and embedded supervision frameworks for:

Pension funds

Asset managers

Law firms

Regulators

Financial institutions

Our edge:

We don’t sell tokens.

We don’t manage assets.

We provide risk clarity.

Interested in licensing the RFS DeFi Risk Platform or receiving bespoke risk briefings?

📩 Contact: [email protected]

🫱🏽🫲🏿 Support RFS Risk Intelligence Weekly

If you enjoy our weekly research and want to support continued independent risk analysis, consider:

Gif by xbox on Giphy

☕️ Buy Me a Coffee — Fuel future newsletters!

💸 Tip in USDC: Ethereum 0x695B71a929A21F2A260f61aEd09872DA053Bcc42 — secured via Gnosis Safe

💳 Tip via Stripe — One-time or recurring support.

📢 Call to Action

Interested in joining the pilot or accessing our full whitepaper? — Email [email protected] (Subject: Pilot Enrollment Request)

💼 Custom engagements | Audit-aligned scoring | Institutional onboarding

🛜 Join Our Community — Let’s Get to 500 Subscribers!

Be part of the RFS DeFi Risk Intelligence Network — our goal is to build a vibrant global community of 500+ institutional readers, builders, and compliance professionals advancing responsible DeFi.

Don’t Forget to Follow and Engage with Us:

🌐 RFS Consulting Website: www.rfsconsultingglobal.com

🎥 RFS YouTube Page: @RFSConsultancy_DeFiAdvisory

🔗 RFS Consulting LinkedIn Page: @rfsconsultingglobal

🐦 X / Twitter: @RFSCryptoDeFi

🖇️ Stay Connected

For partnership or media inquiries: [email protected]

Subscribe to the RFS DeFi Risk Intelligence Weekly

Till next time,

RFS DeFi Risk Intelligence Weekly

🔓Disclaimer: This Weekly is strictly informational—not investment or legal advice. RFS Consulting emphasizes governance, model validation, and data integrity in its risk assessment framework.